Current supply chains support distinct automated cell and gene therapy (CGT) manufacturing elements when they are well-characterized and integrated into commercial manufacturing. As cell therapies develop and become more commercialized, manufacturers must adopt a sophisticated supply chain that provides the necessary materials and technologies to support therapeutic development.

Once a CGT manufacturing process is registered with regulatory authorities, it’s difficult and expensive to change it. CGT manufacturers must ensure their supply chain can support the manufacturing process.

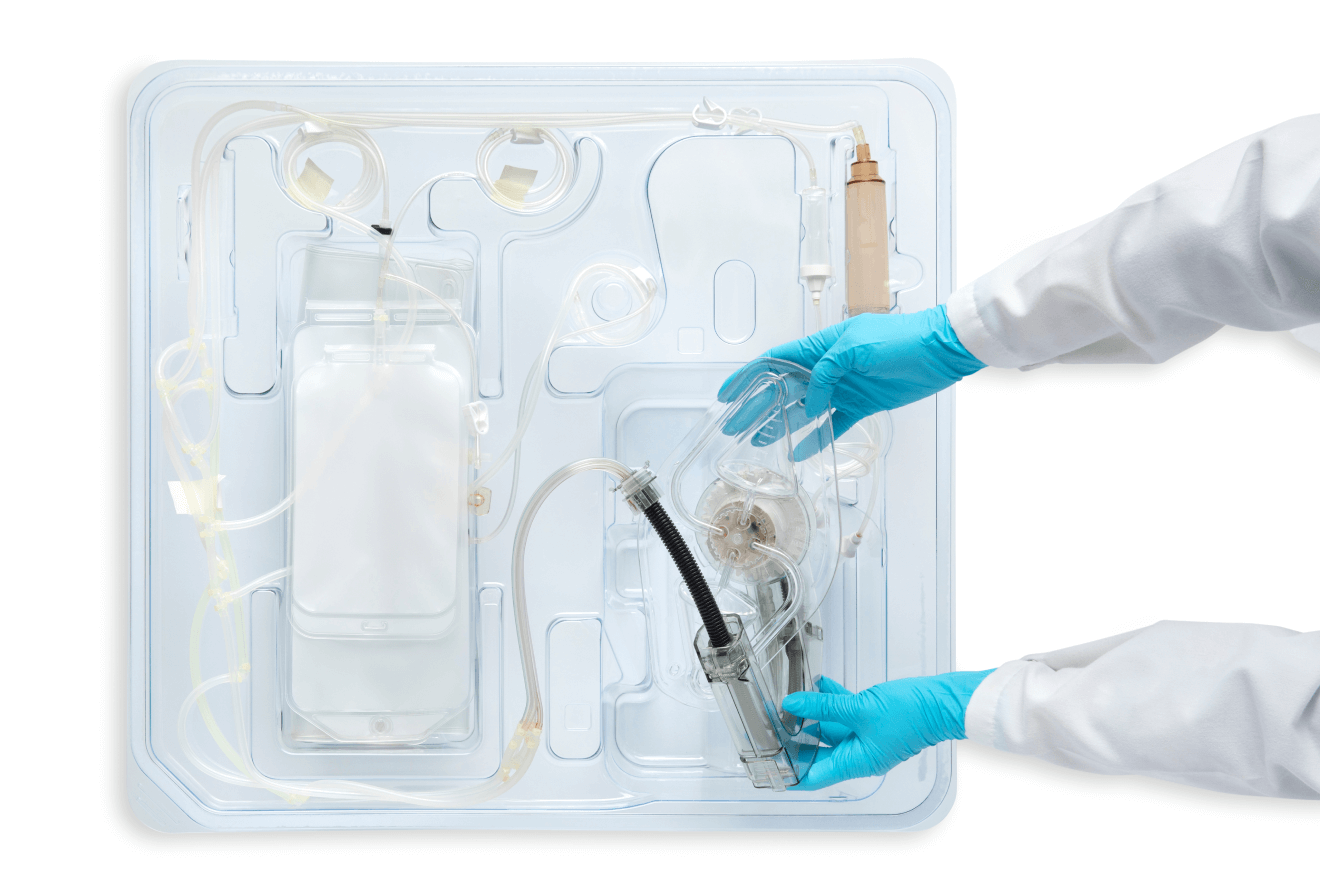

CGT manufacturers must identify suppliers with strong forecasting capabilities, with 12-month rolling minimums linked to accurate materials scheduling with tier-2 suppliers. They must register their single-use sets with the appropriate regulatory authority, such as the U.S. Food & Drug Administration (FDA) or the European Medicines Agency (EMA).

As an example, all single-use set components are typically United States Pharmacopeia (USP) class 6. A good supply chain has a clear link between forecasting, master material scheduling, production and tier-2 suppliers mapped into enterprise resource planning (ERP) and the CGT manufacturers’ supplier management system. Even with all the required master supply agreements in place, if CGT manufacturers are not focused on single-use set areas that could generate problems, they can experience supply chain breakdowns.

A good supply chain provider knows the availability of USP Class 6 components to avoid shortages. Supply chain status should be regularly communicated to the CGT developer (at Invetech, we suggest holding monthly forecast meetings). Good forecasting means supply shortages can be anticipated, so that developers and suppliers can substitute alternate components without interruption.

It’s a given that company procurement will seek cost savings to support commercial viability and increase margin. When setting up a supply chain, CGT developers often compare the costs of similar components. Before making the decision to move forward with any component, developers must look at its one to five-year availability. Failing to take this precaution is a common error that can lead to supply gaps and put the manufacturing process at risk. Supplier risk profiling must be part of the forecasting ERP and supplier quality management system.

A modern CGT supply chain needs support from all key players, especially design engineering at the early design phase. Strong forecasting capabilities and highly transparent communication between the CGT developer, the component suppliers and tier-2 suppliers is essential. Aligning to strategic suppliers allows component supply flexibility and adaptability. Understanding and documenting supplier key strengths in supply of components is highly valuable in the current globalized supply chain and pays for itself by avoiding supply delays.

The cell therapy industry is still young and not well established, and components and technology will continue to evolve. CGT manufacturers need a supply chain that is both nimble and adaptable. In the current globalized supply chain environment, with specific manufacturing regions developing and evolving, suppliers are increasingly taking on the responsibility to manage these changes and the supply chain responsibility will continue to evolve in this area.